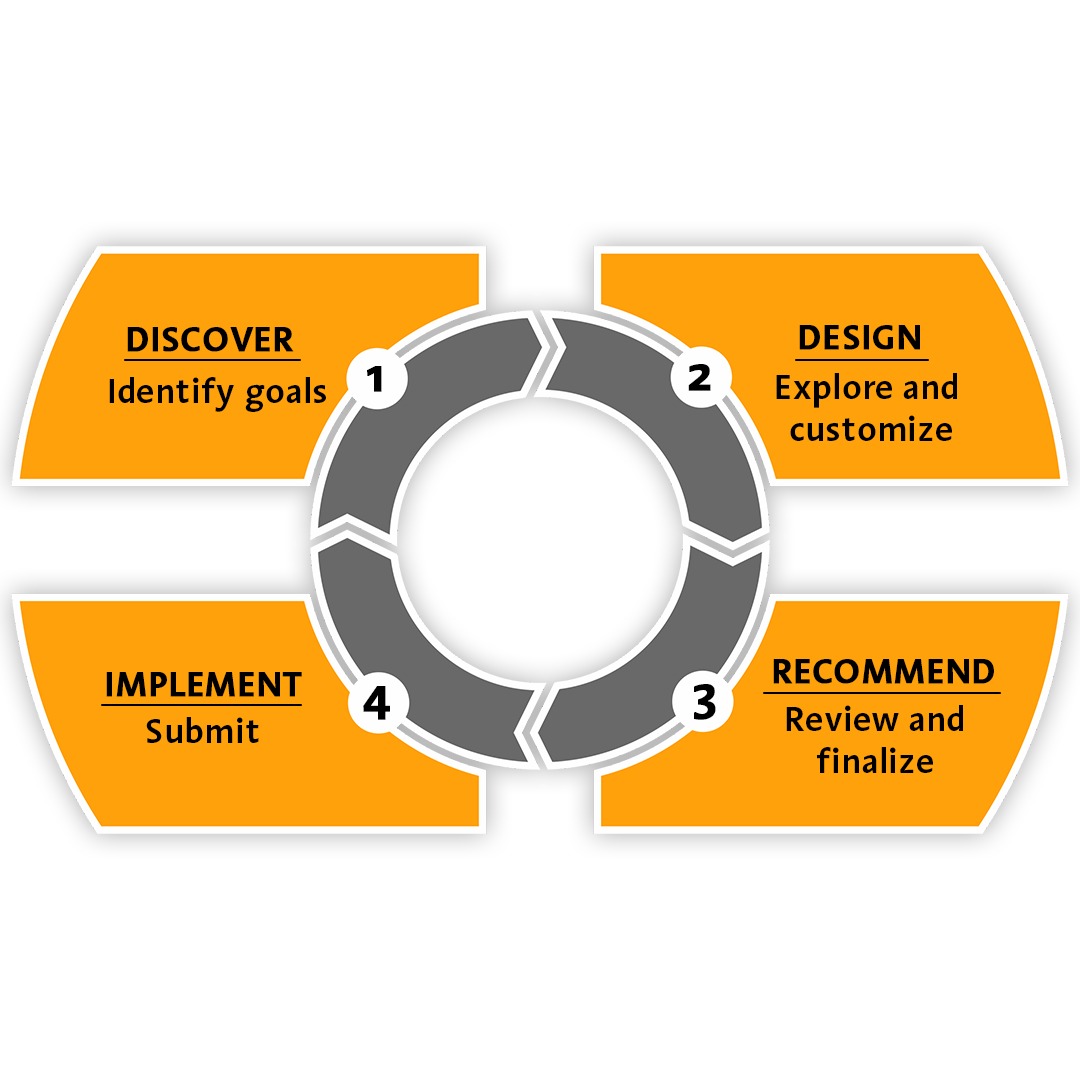

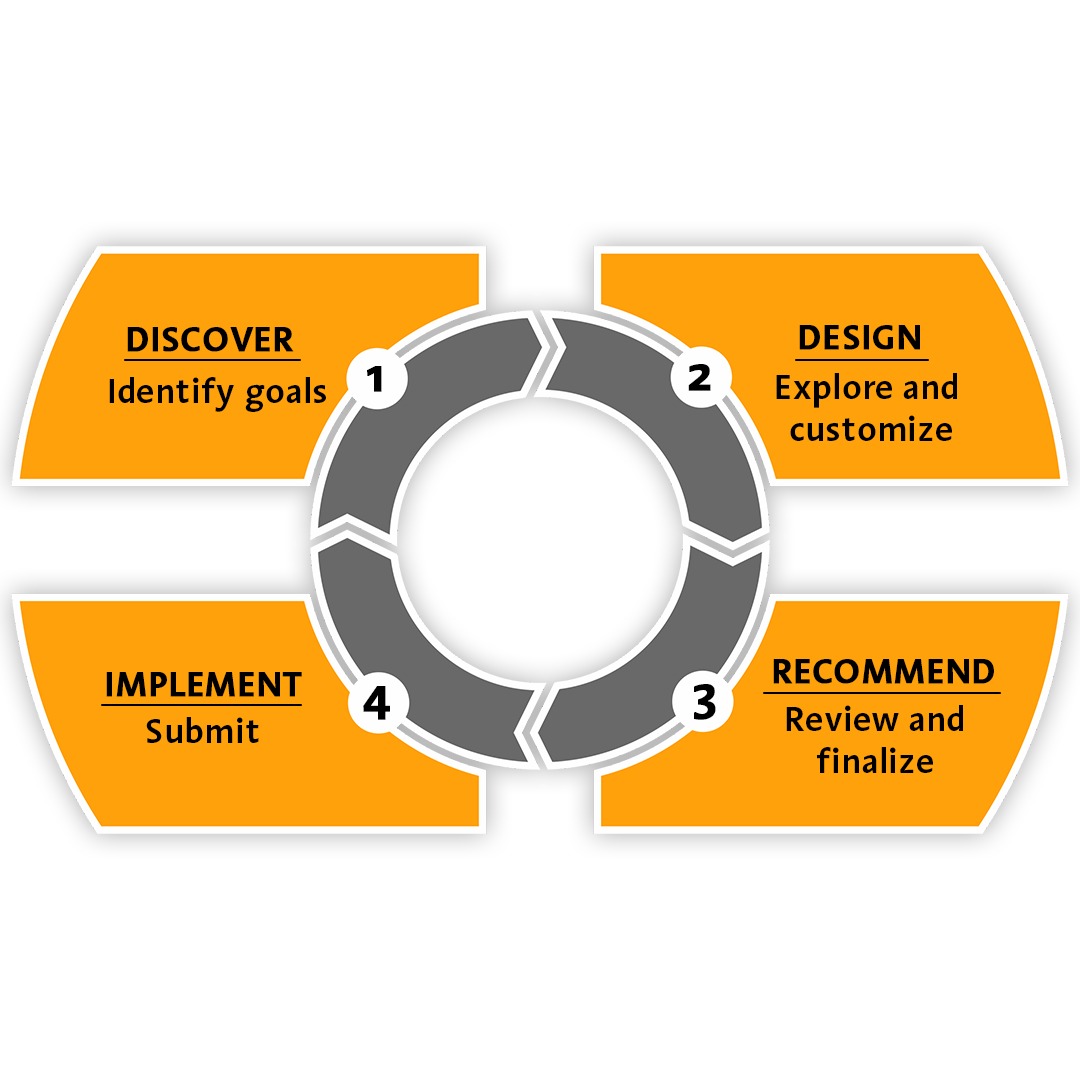

Systematic 4-step approach

Working together, we'll use our proven process to finalize the best financial strategy for your needs.

Our Systematic 4-step approach

Working together, we'll use our proven process to finalize the best financial strategy for your needs.

Working together, we'll use our proven process to finalize the best financial strategy for your needs.

We would like to learn about you, your age, your family (dependents) and your employment. If you have your retirement secured, your family is protected. No wonder, if you have not yet thought about it. Our advisor will assist you through it.

We would like to learn about you, your age, your family (dependents) and your employment. If you have your retirement secured, your family is protected. No wonder, if you have not yet thought about it. Our advisor will assist you through it.

Our advisor will compile a personalized strategy for your short-term and long-term goals, selecting the right investment product for you while working through your estate considerations and protecting you & your loved ones with insurance.

Our advisor will compile a personalized strategy for your short-term and long-term goals, selecting the right investment product for you while working through your estate considerations and protecting you & your loved ones with insurance.

It speaks about why we need your personal information and how we are committed to keep your information secure.

It is a document produced in the discovery session and may be amended until the goals are fully defined .It specifies how the need was evaluated for your personal situation.

It is a story letter which contains the overview of your goal definition and the reason why a given strategy and the plan is selected. It helps the client to review their policy at a later moment, should the situation change in future.

Our clients are precious and they receive a complimentary lifelong service from us. Our advisors remain in touch with clients for periodical reviews to check if any changes may be required in their insurance policy like getting married /divorced, buying property, expanding business would mostly demand revision in your existing portfolio. You will never be alone when you need service and recommendations from experts.